To B or Not to B?

The B Corp is emerging as an innovative way to use the power of a business model and the market to help impact the major societal problems of our times.

The B Corp may emerge as an alternative or a complement to much of the work being done now by the nonprofit sector. Time will tell how they are perceived, although both options are obviously important and both should prosper. There is room for both and more.

The idea is certainly welcome. For years, I have been railing about our sector calling itself “non-profit,” one of the least important aspects of what we do, just descriptive of what we are not. My suggestion has always been to talk about a “societal benefit” organization that meets IRS code for charitable deduction status.

We are “for” a number of things ourselves, mostly positive change in areas confronting our societies as well as enrichment, enhancement and education of our citizenry. We also need bottom lines for growth; we need to be efficient, and gradually, we are learning how to measure our results, perhaps impact, in ways that become part of a different kind of “market.’

The Benefit Corporation

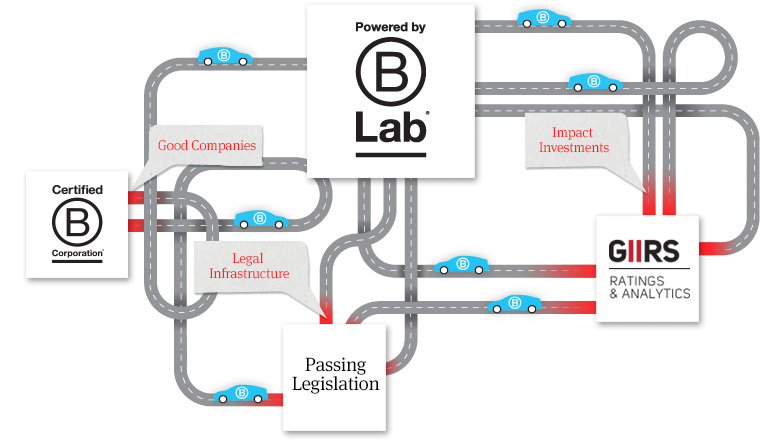

Now we have the B Corp, the benefit corporation. It is for-profit and for-societal benefit, for social and environment change. Under 1000 organizations have become certified by a nonprofit called B Lab, which is promoting the idea and establishing standards and practices which companies must meet for B Corp designation.

The B Corp created national attention last fall when Ben & Jerry’s ice cream company became certified as a B Corp by B Lab, the guardian of the concept and keeper of the standards. The B Corp is defined on their website in the following way:

“B Corp certification is to sustainable business what Fair Trade certification is to coffee or USDA Organic certification is to milk. B Corps are certified by the nonprofit B Lab to meet rigorous standards of social and environmental performance, accountability, and transparency.”

Social Impact Investments

What is especially interesting about these for-profits groups is that they are attracting social impact investment. Think of all of those large Foundation endowments and how they might be invested now for a double or triple return. Rockefeller, Annie E. Casey and Skoll are already there.

Getting the list of these companies is the first step in trying to figure out where to put your money. B Lab has made it even easier through detailed analysis of B Corps impact in its Global Impact Investing System. This third-party, independent rating system looks at social and environmental impact of both the companies as well as the social impact investment funds out there, in a way they say is similar to “Morningstar investment rankings or S&P credit risk ratings.” For their reasons, they do not include financial performance, which is available elsewhere.

To date, over 60 funds and 400 companies are being GIIRS-rated, with 21 institutional investors using the GIIRS ratings in investment decisions.

The potential is large, tapping into the financial investment side of the foundations, corporations or individuals’ assets. Returns delivered from these sources of investment are then available for grants and charitable donations. It’s a real win-win.

A Work-In-Progress

The B Corp is still a work in progress. Twelve states so far have enacted laws to permit this alternative corporation. The group is actively involved in advocating for adoption of laws in the remaining states to gain national recognition for the concepts.

The B Corp is also evolving as more and more variations on the model are emerging and as more and more societal and environmental categories present themselves.

The science of measurement also is also evolving. What is attractive is the B Lab’s system of evaluation and measurement which they characterize as comparable. They do not go into detail on their website on methodology, so we will assume that it also is a work in progress.

The next few years will not only see mergers and acquisitions, the now-traditional way to deal with the overabundance of nonprofits and the tightening gift and grant parameters, but with a range of new and creative solutions to funding organizations and people who work to find solutions to complex societal problems. It is an exciting time.

Jim – Thank you for talking about this important issue. As one of 3 certified B-Corps in MN, thedatabank, inc, is proud to be part of a rapidly growing group of businesses that believe responsibility doesn’t end with shareholders. I hope that Minnesota will pass Benefit Corporation legislation this year. This really needs to happen so we can build the support network of funders and other service providers that will drive the growth of B-Corps in Minnesota.

Chris Hanson

CEO & Co-founder

thedatabank, inc.

Chris: I’m so pleased to hear from you and to learn that the Databank is a Minnesota B Corp.

Clearly, it is in the spirit of what you’ve stood for in your career and I salute you and your colleagues.

Should I be of any assistance in the session, I’d be happy to help. Please feel free to send my article to Legislators if you feel it might be useful. Warmest good wishes. jim