Guest Post – In Defense of Taxes—Even If They Might Cut into Charitable Giving

This article was originally published by the Nonprofit Quarterly on January 4, 2013

In recent weeks, nonprofit organizations mobilized against the threat that Congress would limit tax deductions for charitable gifts. Because charitable deductions provide an incentive for giving, many nonprofit leaders fear that scaling them back will make it harder to raise money. Following the “fiscal cliff” negotiations, the charitable deduction remains more or less intact—at least for now. As we consider the broader implications of tax reform and government spending and gear up for legislative fights to come, I am concerned that many of my nonprofit colleagues are overreacting or—even worse—responding to the wrong threat.

First, a few facts about charitable giving. Seventy percent of American households contribute to nonprofits. Only one-third of taxpayers itemize their deductions. In other words, a majority of donors currently get no tax benefit from their giving, and yet they continue to give. If the charitable deduction is reduced, experts project that donations will decline by one to three percent, hardly worthy of the panic we see in the nonprofit community. Why can’t we accept this loss and say, “We are willing to do our part”—especially if increased revenue helps to protect government programs that serve our nonprofit clients and customers?

The larger issue is the demonization of government and the culture of tax avoidance. For the past thirty years, we’ve heard the insistent drumbeat of the argument that government is bad, and therefore paying taxes is a waste of money. A recent vice presidential candidate called taxes “unpatriotic.” I prefer the perspective of Supreme Court Justice Oliver Wendell Holmes, who said, “Taxes are the price we pay for a civilized society.” While many nonprofit networks were mounting an all-out campaign to preserve the charitable deduction, a handful of important voices—including author Kim Klein and Aaron Dorfman of the National Committee for Responsive Philanthropy—were offering more nuanced messages, in the spirit of Justice Holmes, about tax policy, equity, and democracy.

Nonprofit leaders, who are daily healing the sick, caring for the needy, protecting the environment, serving our spiritual needs, enriching our communities with arts and culture, and so on, need to talk more about what we buy with our tax dollars. We buy not only a safety net for the poor and dignity for the elderly, but also roads, bridges, courts, parks, public safety, public schools, public airwaves, regulations that protect our food, water, air, workers, drivers, other species, etc. Government is not “them.” It is us. It’s how we express our common values and create shared rules and expectations. These things enrich our lives, so it’s appropriate to support them with our taxes. Furthermore, those who vigorously avoid paying taxes continue to use government services while shifting the costs to others. At the very least, this is unfair. Under some circumstances, it’s criminal.

Let me be clear: healthy skepticism about government behavior is a fine thing. We can and should argue about the specific ways our government spends money—too much on pointless wars, in my opinion—and we must hold our elected officials accountable for their decisions. Furthermore, there is no shame in claiming legitimate deductions. Congress and our state legislatures create tax breaks, including the charitable deduction, as a way of implementing public policy. A few years ago, while legislators debated the state budget, I marched in front of the statehouse carrying a sign reading, “I will pay more taxes.” Dozens of my Vermont neighbors joined the rally to make the same point: government serves the common good and paying taxes is a patriotic and necessary act.

Nonprofit leaders can and should take the lead in delivering this message. The current debates about government spending and fiscal policy offer a great opportunity to say, “We are willing to risk a small decrease in charitable donations to strengthen the common good.”

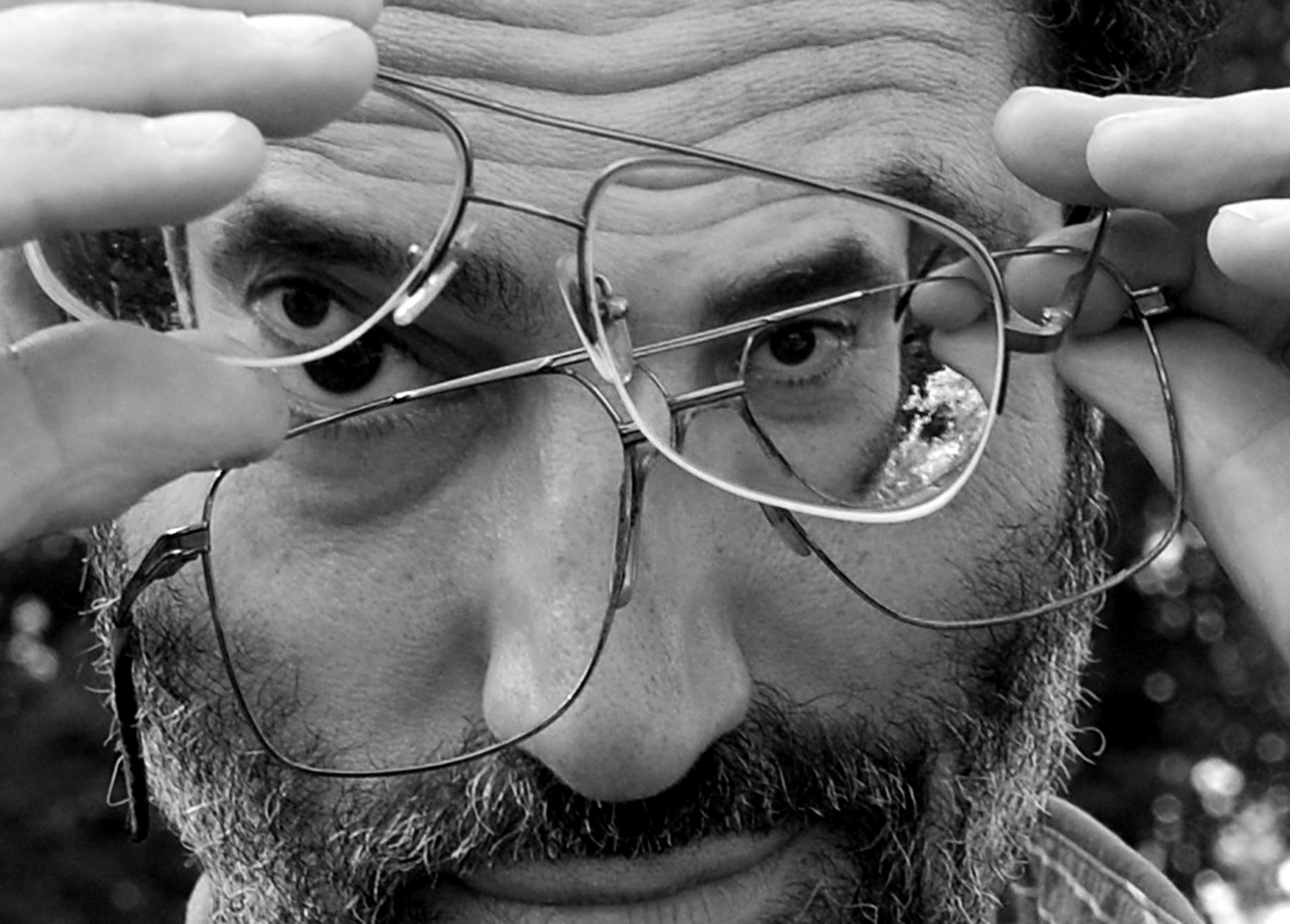

Andy Robinson provides training and consulting for nonprofits in fundraising, grantseeking, board development, marketing, earned income, planning, leadership development, and facilitation. He also serves government agencies and, on occasion, corporate clients. Over the past seventeen years, Andy has worked with organizations in 47 US states and Canada. Recent clients include the American Bar Association, National Wildlife Federation, Vermont Department of Health, National Audubon Society, and the Center for Progressive Leadership.

Andy is the author of five books, including Grassroots Grants and Selling Social Change, available from Jossey-Bass. His latest books, How to Raise $500 to $5000 From Almost Anyone, The Board Member’s Easier Than You Think Guide to Nonprofit Finances, and Great Boards for Small Groups, were published by Emerson & Church. When he’s not on the road, he lives in Plainfield, Vermont.

Questions: How wealthy are the 1/3 that claim charitable giving on their taxes? What is their average gift? I would claim donations on my taxes if I could actually make large enough donations to do so…

Would the wealthy still give the same amount?

I don’t disagree with what you have said, but I would like to get more facts…

Thank you

Jenny

Jenny, the best source of data to answer this question is Giving USA. My understanding is that the one-third of donors who itemize provide more than half of contributed dollars from individual donors, but I can’t be more specific. As noted in the original article, the best estimate is that ending the charitable deduction would reduce overall giving by 1-3%. People give for a lot of reasons — the tax break is one of them, but it tends to be small in comparison to other motivators.